Rolex Price Increases Over Time

Oct 7, 2019 00:00 · 608 words · 3 minute read

Rolexes have always been expensive watches, of course. But they’ve gotten more expensive over time, even adjusting for inflation.

For example: a stainless steel Submariner (without the date complication) cost $155 in 1957. In 2019 dollars, that’s around $1400, which is about the price of a new 13" Macbook pro. Rolex now sells that same model for $6300, which is a pretty big difference.

These watches don’t follow our usual intuition for prices. In the Econ 101 explanation, as prices go up demand should go down. But demand for Rolexes has not gone down. Rolexes are Veblen Goods. Veblen goods have the curious property that as their price goes up, demand also goes up. People want Rolexes to show that they have Rolexes. And like many other luxury brands, Rolex AB knows this. So they price accordingly.

Using data from Rolex AB provided to Minus4Plus6 (a hobbyist site unaffiliated with Rolex) we can look at this trend over time. I’m not sure if this data is exhaustive, or if we’re missing models or time points. I have adjusted the prices to constant 2019 dollars to allow for comparison between times1.

Summary statistics

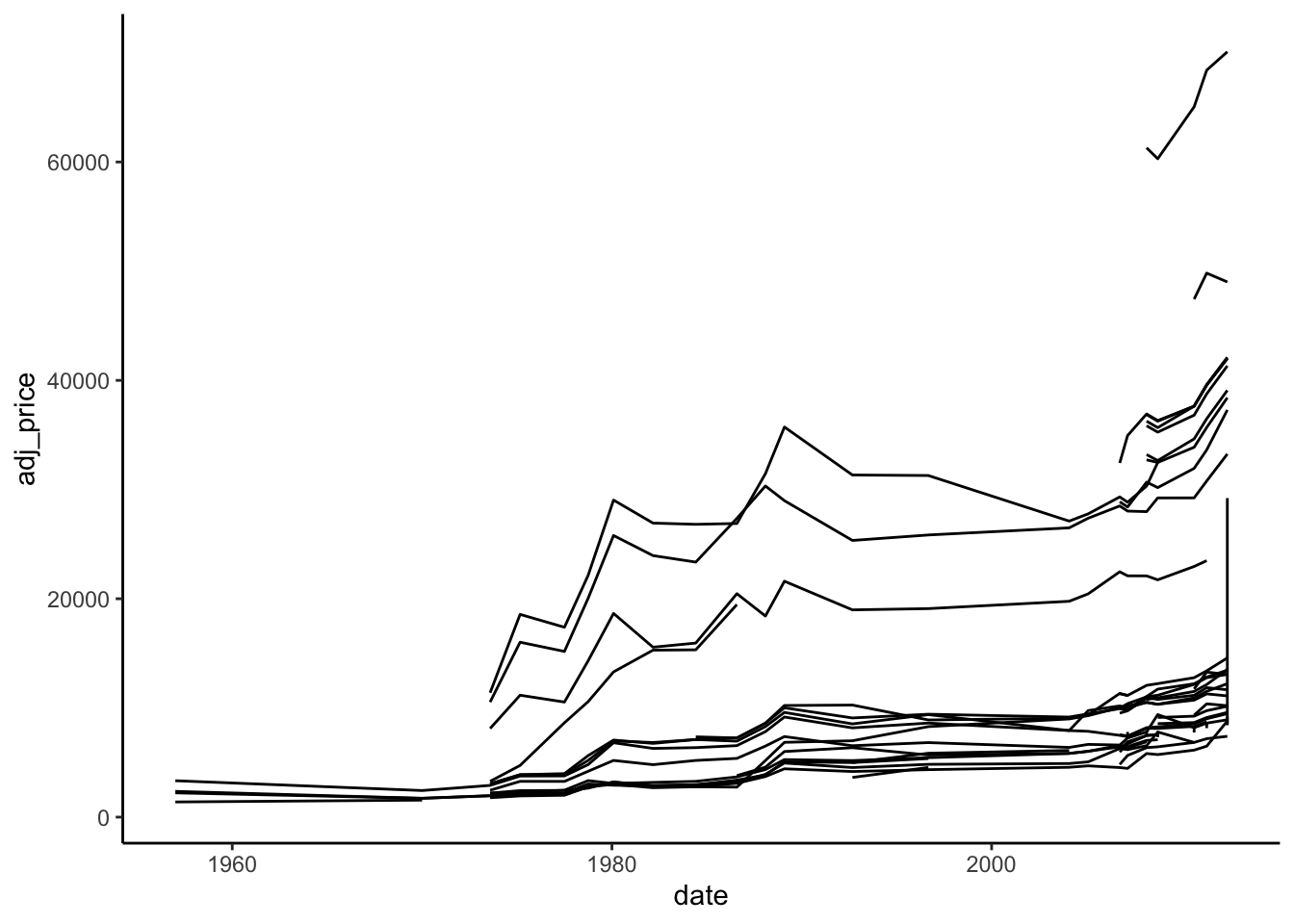

Note that we only have sparse data (in terms of both model counts and reporting frequency) until the 1970s. In the 21st century we have model counts in the 30s.

Again, I want to highlight that these are inflation-adjusted plots in this post. If there was no real increase, the plot should be flat. So there has been considerable increase in Rolex prices as time goes on. Additionally, the mean and median don’t change together. Means are sensitve to outliers, and the way that the mean begins to outpace the median reflects the introduction of some high-price models as time goes on (at least in this dataset).

This is another look at median rolex prices, with the area between the 25th and 75th percentile highlighted. I’ve also added a smoothing line in blue.

Individual Watches

I’ve added a smoothing function in black to show the overall trend. Notice the sharp increase in the price for the Lady Date to align it with the rest of the product lineup.

For the sake of completeness, here is a plot of all the models in this dataset. Unlabled, because distinguishing this many models would be a mess.

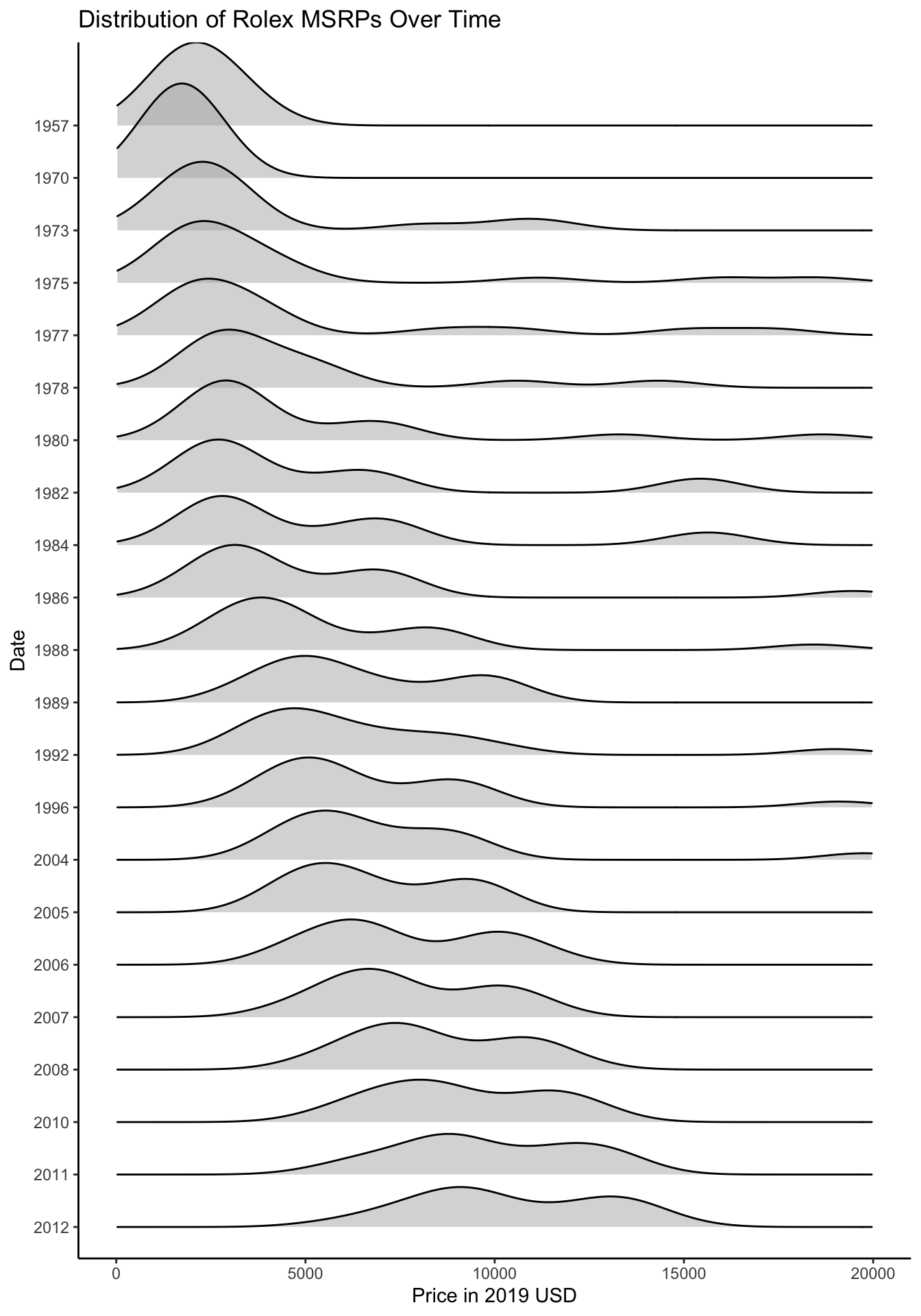

Again, the we’ve cut the X-axis at $20,000 for clarity.

We can also take a look at the distributions over time.

Pretty clear increase over time.

Context

This is a short visualization, not a proper analysis so there may be something going on that could cause the increase that isn’t just a price increase for the sake of increasing the price. Mechanical watches have been largely supplanted by much cheaper and more accurate quartz movements. Perhaps the watch makers can command a higher wage with less competition? These latest increases seem to have started in earnest after the financial crisis, not exactly a period of wage increases and luxury purchases.

Maybe there is some long-term trend in the relationship between the Swiss Franc and US Dollar that is responsible? This is what Minus4Plus6 suggests. I was more skeptical so I pulled some historical exchange rates2 to take a look.

While the exchange rate has changed considerably over time, I can’t see anything that would explain the recent large increases in price.

For lack of an immediate better explanation, I’ll go with the idea that Rolex is now directly considering its Veblen status in its pricing. Raising your prices after the ’08 global financial crisis would be very strange behavior otherwise.

CPI data retrieved from https://fred.stlouisfed.org/series/CPIAUCSL 09/19/2019↩

Historical USD-CHF rates from https://www.investing.com/currencies/usd-chf-historical-data, 10/07/2019↩